Barclays Plc’s possible withdrawal from South Africa may turn out to be the economy’s biggest no-confidence vote at a time of financial-market turmoil and policy uncertainty.

Offices of Barclays Plc in Johannesburg, South Africa. Photographer: Dean Hutton/Bloomberg

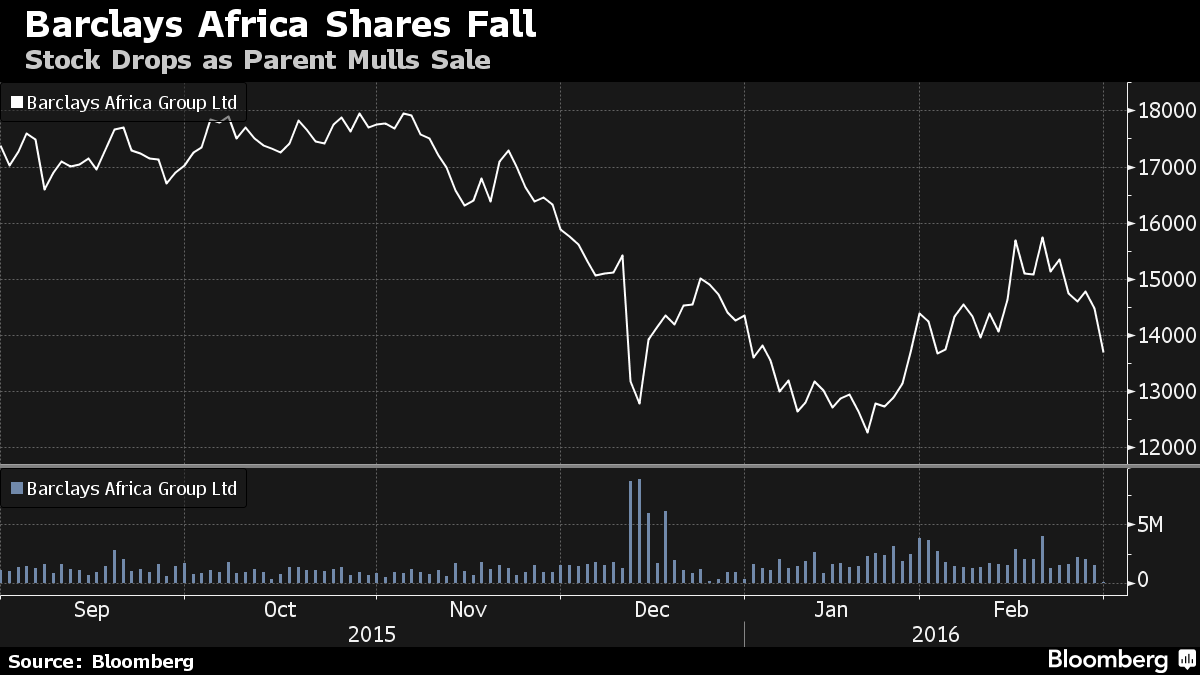

As the economy hovers near recession and a credit-rating downgrade to junk looms, speculation is mounting that London-based Barclays Plc may sell its 62 percent stake in its Africa operations, valued at about 72 billion rand ($4.5 billion). About 80 percent of Barclays Africa Group Ltd.’s profits come from South Africa, where the currency has lost 35 percent of its value against the dollar since the start of 2014.

“There’s been a very significant withdrawal of capital out of this country,” Nic Borain, a Cape Town-based political analyst and adviser to BNP Paribas Securities South Africa, said by phone on Monday. “Unfortunately, there’s no way of avoiding the conclusion that this may be seen as yet again a vote of no confidence in the economy’s growth potential.”

Barclays plans to exit its African business as part of an overhaul of the company and Chief Executive Officer Jes Staley will probably announce a company-wide review on Tuesday, according to a person with knowledge of the discussions.

Anglo Disposal

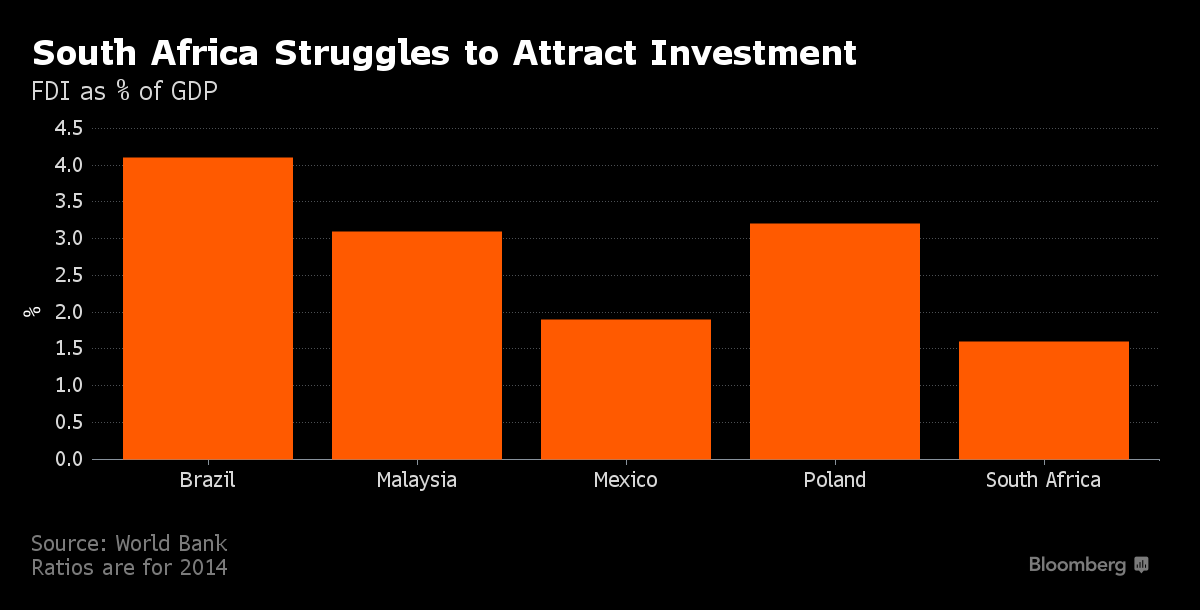

South Africa has been struggling to attract meaningful foreign direct investment as a slump in commodity prices and a slowdown in China weighs on growth. The news of a potential Barclays exit comes after Anglo American Plc said on Feb. 16 it may scale back its South Africa operations by selling coal and iron ore assets. Anglo lost three-quarters of its market value last year as metal prices slumped.

FDI into South Africa amounted to 8.9 billion rand in the first three quarters of last year, compared with 62.6 billion rand for the whole of 2014, data from the central bank shows.

Business confidence is near a 22-year low and the worst drought in more than a century threatens to cut this year’s economic growth rate to 0.9 percent, the lowest since the 2009 recession, according to government forecasts. Slow growth is a key concern for credit-rating companies such as Standard & Poor’s, which holds a negative outlook on South Africa’s BBB- credit rating, the lowest investment grade level.

Sentiment was damaged after President Jacob Zuma appointed two finance ministers in four days in December, sending the rand and bonds plummeting. Investors are still concerned about stability at the National Treasury amid what is seen as a power struggle between Zuma and Finance Minister Pravin Gordhan.

“The South Africa story is not as attractive going forward as it was,” Lumkile Mondi, a senior lecturer at the school of economic and business sciences at the University of the Witwatersrand in Johannesburg, said by phone on Monday. “South Africa has policy uncertainty, there’s indecision” and the growth “that was expected in the medium term now doesn’t look possible,” he said.

FDI into South Africa declined to 1.6 percent of gross domestic product in 2014 from 2.2 percent the year before and is almost half the ratio of 3.3 percent in emerging-market peer Malaysia, according to World Bank data.

Barclays first bought a controlling stake in the South African lender in 2005 as part of a strategy to find growth outside of its home market, where lending was slowing, and to consolidate its businesses across Africa. A spinoff of the Africa unit may help to bolster Barclays’ capital, which is below its own target and the weakest of any major U.K. lender.

Barclays Africa dropped 6.1 percent to 136 rand in Johannesburg on Monday, the biggest one-day decline since Dec. 10.

“This is just another piece of straw on the camel’s back,” Bart Stemmet, an economist at NKC African Economics, said by phone from Paarl, near Cape Town, on Monday. “For a long time there was the sense that investors will come because we have growth, but now we don’t have growth anymore. We are far behind, not just in giving investors certainty around legislation, but also by actively courting foreign investors.”