Cellulant, a leading Pan-African digital payments service provider that prompts, collects, settles and reconciles payments in real time, has raised $47.5 million from a consortium of investors that include the Rise Fund, the impact fund run by private equity group TPG Growth, Endeavour Catalyst and Satya Capital, the private equity firm owned by Sudanese-British billionaire Mo Ibrahim.

The deal is the largest involving a FinTech company that does business only in Africa, according to a press statement by the Rise Fund.

“Much of the [FinTech investment] activity in recent times in Africa has been specifically in the consumer lending space,” said Yemi Lalude, TPG’s managing partner for Africa, in a press statement. “This is different from that. What Cellulant has is a payment platform that enables people who have not had access to financial payments to get access in a way that is transparent.”

Cellulant plans to plough the new capital into scaling up the company’s operations and expanding into two African countries this year. The company will also channel a significant portion of the funds into Agrikore, its blockchain based smart-contracting, payments and marketplace system that ensures that everyone in agriculture (Farmers, FMCGs, Agriculture inputs providers, produce aggregators, insurance companies, financial institutions, governments, development partners) can do business with each other in a trusted environment.

“We are scaling up our existing payments products in the agriculture sector, digital banking and internet payments; as well as introducing consumer-focused products to complement the enterprise products we already have,” Akinboro said in a statement to Nigeria’s Business Day. “This will allow us to increase access to payments for the millions of Africans who are still unbanked, despite the financial inclusion revolution.”

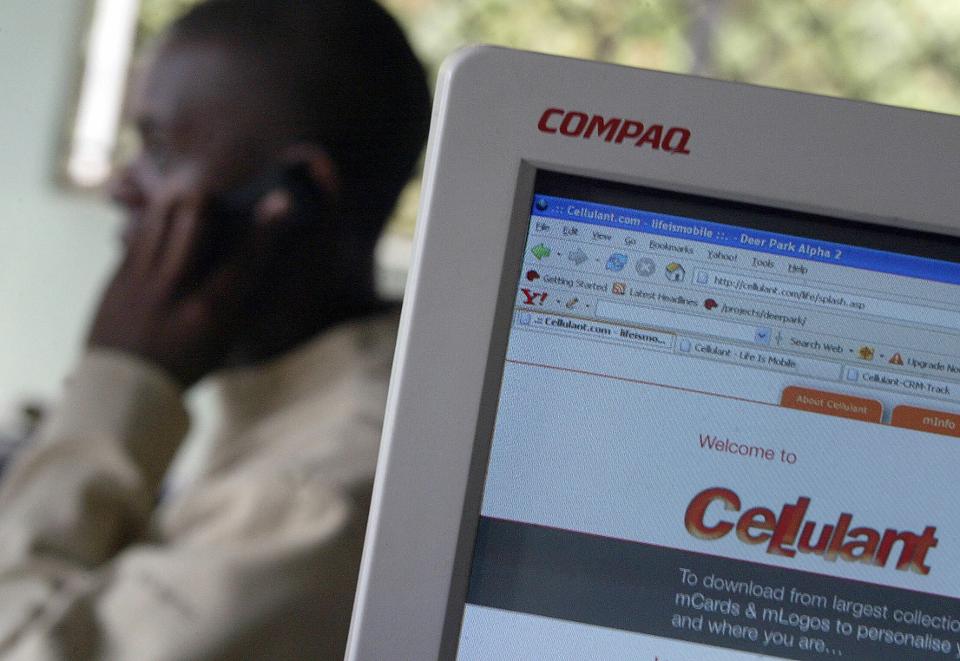

Cellulant was founded in 2004 by Kenyan entrepreneur Ken Njoroge and his Nigerian partner, Goke Akinboro. The company’s works with more than 90 banks in 11 countries and has more than 100 million customers.