Johannesburg, 12 October 2023 – The Experian Business Debt Index (BDI), which reflects the overall health of businesses in the economy, declined in Q2 to 0.445 from a slightly upwardly revised 0.740 in Q1.

This decline was less than anticipated considering the better than forecasted outcome for Q2 GDP growth in both South Africa and the US.

“Domestically, the improvement in GDP growth in Q2 above expectations was attributable to a reduction in the intensity of load-shedding from May onwards and an increase in fixed capital formation, which now exceeds consumer spending,” says Jaco van Jaarsveldt, Head of Commercial Strategy and Innovation at Experian Africa.

South Africa’s quarter-on-quarter seasonally adjusted GDP growth in Q2 came in at 0.6%, somewhat better than the -0.1% growth predicted for that quarter. On a year-on-year basis, South Africa’s GDP growth rate rose significantly, from 0.2% in Q1 to 1.7% in Q2.

Quarter-on-quarter growth in fixed capital formation rose to 3.9% in Q2, in contrast with the minor 0.3% growth in household consumption expenditure. This trend of fixed investment growing faster than consumer spending has been in place for six consecutive quarters and constitutes an encouraging structural improvement in the economy.

“In earlier years, the excess of consumer spending over fixed investment generated an unsustainable situation in which insufficient resources were being allocated toward ensuring the sustained production of goods and services, in relation to what was being demanded by consumers,” adds van Jaarsveldt.

This pattern has now encouragingly been reversed. In particular, the increased interest in renewable energy projects and related machinery and equipment, stimulated an overall improvement in fixed investment.

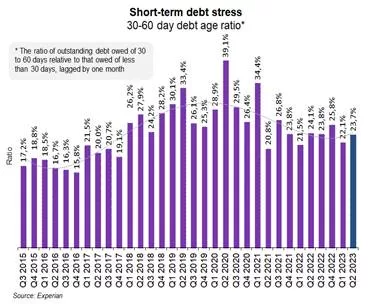

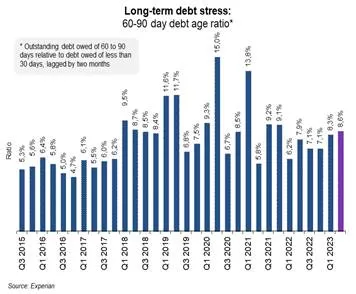

Debt metrics show slight deterioration

“The debt age ratios, although deteriorating from what was observed past quarter, did not reflect a significant change from Q1. This suggests that the business sector (including SMEs) is demonstrating resilience in the overall performance of the South African economy, notwithstanding the headwinds posed by load-shedding and an inadequate rail network system,” adds van Jaarsveldt.

Agricultural sector demonstrates marked recovery

From a sectoral point of view a highlight of Q2 was the substantial recovery in agricultural output compared with Q1. GDP growth in agriculture recovered from -11.9% in Q1 to a positive 4.2% quarter-on-quarter in Q2. A reduced incidence of load-shedding undoubtedly played a significant role, allowing for less disruption to irrigation and supply chains in the agricultural sector.

In so far as the remainder of the sectors, they all experienced a decline in Q2, with the BDI for Financial Services dropping below zero for the first time in years.

Van Jaarsveldt concludes, “As businesses continue to endure a tough economic climate, effective debt management is crucial to long term sustainability. While the prognosis for the short-term is not favourable, optimism rests on progress being made in improving the country’s ability to generate electricity through renewable energy. This will require investments directed at enhancing such possibilities and in improving the logistical environment, especially the ability to transport goods through rail and enabling South African harbours to operate at full capacity.”