KKR & Co, one of the largest private equity firms in the world, plans to invest as much as $100 million in Africa within the next one year, according to Reuters.

During a visit with a French business delegation to Nigeria, Dominique Lafont, a senior advisor at KKR, said the private equity firm is looking at investing in the agriculture and energy industry as well as in infrastructure projects.

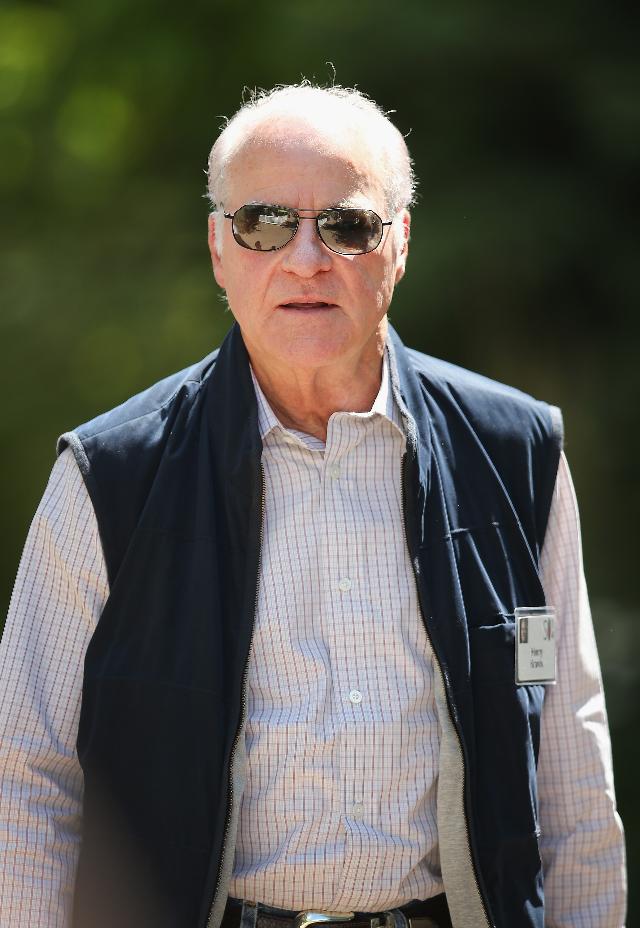

Henry Kravis, co-chairman, co-chief executive officer and co-founder of KKR & Co (Photo by Scott Olson/Getty Images)

“We want to use Nigeria as regional base and springboard for West Africa,” he said, according to Reuters. “We are not limited to one sector.”

KKR, which was founded in 1976 by Henry Kravis and George Roberts, now billionaires, and Jerome Kolhberg. Jr. (who died in August), would be following in the footsteps of firms like Carlyle Group and Blackstone, which have begun making investments in Africa.

Also published on Forbes.