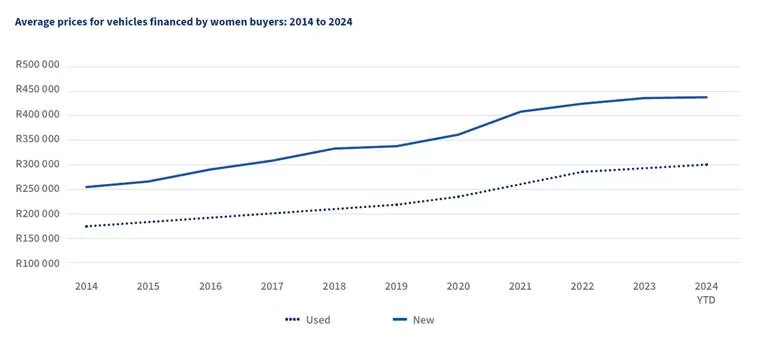

Women are active buyers and sellers in South Africa’s motor vehicle markets and are paying 74% more for their new and used vehicles, on average, than they did in 2014.

Lightstone’s analysis of data gleaned from their transactional systems (see graph below) shows the average price for a used vehicle financed by a woman buyer climbed from R172 600 in 2014 to R297 800 in 2024, while the average price of a new vehicle financed by a woman buyer leapt from R252 000 in 2014 to R440 000 in 2024

Andrew Hibbert, Auto Data Analyst and Team Lead at Lightstone, a provider of comprehensive data, analytics and systems on property, automotive and business assets, said the ratio of average used price to average new price had remained relatively constant over the last decade. “It was 1.5:1 in 2014, the same that it is now in 2024. The only movement away from this ratio was between 2018 and 2021 when it was 1.6:1”, he said.

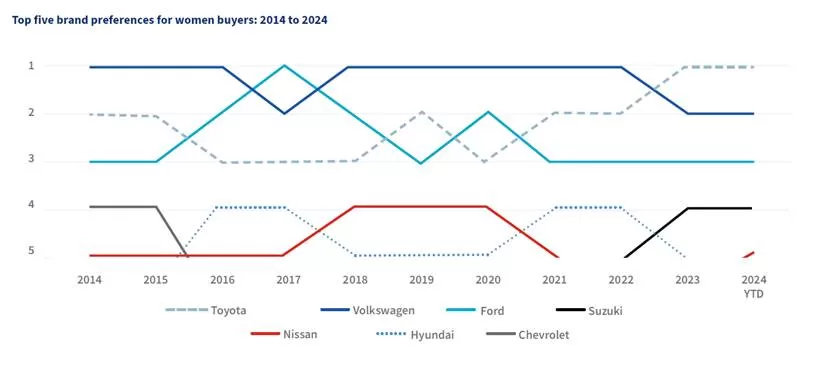

While prices of new and used vehicles had risen over the years, the top three brand preferences remained consistent – although positions have changed. Hibbert said Toyota had moved from second in 2014 to first in 2024, while Volkswagen moved in the opposite direction – although Volkswagen did lead the pack for seven of the 10 years.

image016.jpg

Hibbert said Ford started and ended the decade in third place but did go to the top in 2017, while

positions four and five changed hands fairly frequently with four brands represented over the last 10 years. Currently (so far in 2024) these positions are held by Suzuki and Nissan.

Women buyers have a clear preference for new Crossover/SUV and Hatch bodyshapes, as the graph above shows.

The Crossover/SUV moved into second spot in 2015, passing the Sedan on its way down the popularity chart, and has grown strongly since then, becoming the number one choice in 2020.

Hibbert said the Hatch fell from just under 45% share in 2014 to around 30% in 2024, but was still well ahead of the other bodyshapes which are clustered around a 5% share. The Sedan/Estate had crashed from second spot (20%) in 2014 to fifth in 2024, at just around 4% of new vehicle sales to women.

The Crossover/SUV and Hatch have not dropped below 70% of sales to women since 2018 and accounted for 77% of sales to date in 2024, ahead of the industry average of 62% of Light Vehicle sales reported by the dealer channel.

There had been a similar shift in the used vehicle market (see graph below), Hibbert said, where Crossover/SUVs overtook the Sedan/Estate in 2016, and had grown strongly ever since.

“The Crossover/SUV shape accounted for 41% of all used car purchases made by women in 2024, with the Hatch at 34%”, he said, while the Sedan/Estate’s fell from 20% in 2014 to around 6% in 2024.